The new five per cent mortgage scheme will probably suit people who have a higher-than-average salary and could make mortgage payments relatively easily, but struggle to save for a large deposit. If you've saved up a 5% deposit you'll probably want to know how much you could borrow with a 95% mortgage, and whether this would be enough to afford a property. Your salary is one of the main things a mortgage lender considers when deciding how much you can borrow. Our 95% mortgage. A 95% mortgage (also known as a 95% LTV mortgage) is a mortgage to purchase a property with a small deposit (atleast 5% but less than 10% of the purchase price). Your deposit is the amount of money that. The scheme will do this by allowing first time buyers to pay a deposit as little as 5%, while avoiding lenders mortgage insurance (LMI). Most banks and lenders require a minimum deposit of 20% of the property’s value for the borrower to be exempt from LMI.

There will be a major boost for first-time buyers in next week’s Budget with the return of 95% loan-to-value mortgages.

The new mortgage guarantee scheme designed to help first-time buyers with 5% deposits onto the housing ladder will be unveiled by Rishi Sunak on Wednesday.

The aim is to stimulate the housing market, get more younger people onto the housing ladder, and increase property transactions; good news for agents.

Mortgages with 5% deposits have been stopped by most banks during the Covid pandemic.

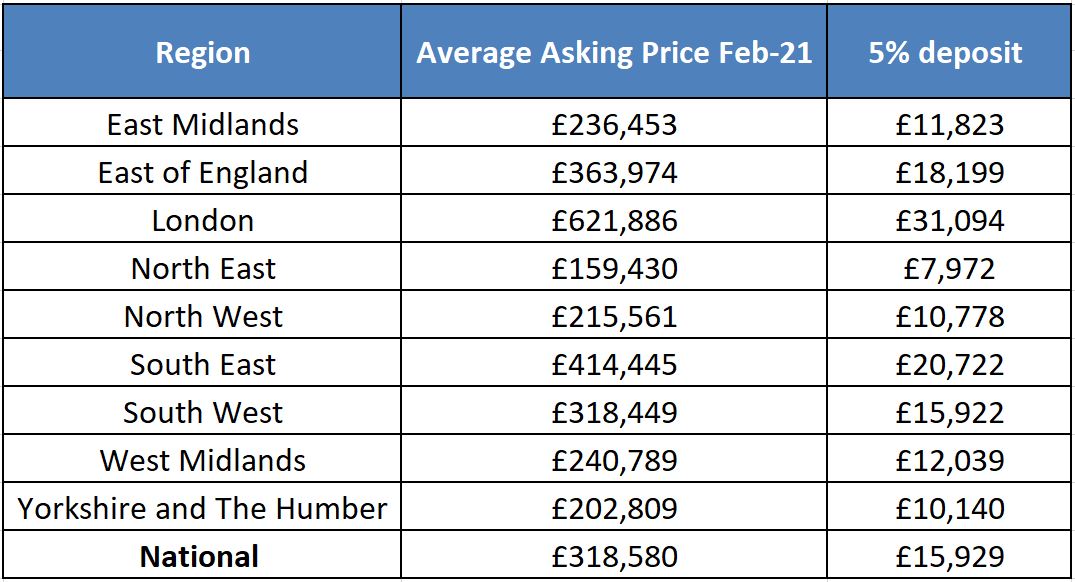

The chancellor plans to incentivise lenders to provide mortgages to first-time buyers, and existing homeowners, with just 5% deposits to purchase properties worth up to £600,000.

Sunak told the press: “Owning a home is a dream for millions and we want to help as many people as possible.”

5 Deposit Mortgages Northern Ireland

Boris Johnson said he wants “generation rent” to become “generation buy”.

The prime minister commented: “Young people shouldn’t feel excluded from the chance of owning their own home and now it will be easier than ever to get onto the property ladder.”

Treasury officials are hopeful that the new scheme, which is a successor to the Help to Buy mortgage scheme introduced by David Cameron and George Osborne in 2013, will provide a major boost to the housing market.

Refinance Rates Us Bank

5% Deposit Mortgage

The chancellor is also expected to use the Budget to announce that the stamp duty deadline of 31 March is to be extended until the end of June.